So, you’re thinking about starting your own business?

Maybe you’re tired of your 9–5 job, want financial freedom, or just have an idea you can’t stop thinking about. Whatever your reason is, you’re here because you want to know how to start a small business the right way.

The good news? It’s not as complicated as it seems.

The key is following a clear, structured process. In this complete small business startup guide, I’ll walk you through starting a small business step by step – without overwhelm.

1. Choose the Right Small Business Idea

Every successful small business starts with a strong idea. But here’s the truth – you don’t need a groundbreaking invention to succeed. You need a solution to a real problem. The best small business ideas focus on solving everyday challenges, saving time, or helping people achieve something important.

Also Read: The 7 Income Sources of Millionaires

Start with Your Skills and Strengths

Begin by looking at what you already know and can do well. Think about your skills, past experiences, and the kind of work people often ask you for help with. When your business is built around your strengths, it becomes easier to stay consistent and confident, especially during the early stages.

If people regularly seek your advice on a particular topic, that’s often a sign of potential demand. Turning an existing skill into a business reduces the learning curve and increases your chances of long-term success.

Validate Market Demand

A good idea must have real demand in the market. Before investing time and money, check whether people are actively searching for or paying for similar products or services. You can explore online communities, industry trends, and customer reviews to understand what people truly need.

Pay close attention to complaints in reviews. When customers express frustration with existing solutions, it creates an opportunity for you to offer something better, faster, or more affordable.

Evaluate Profit Potential

Passion alone cannot sustain a business – profitability matters. Ask yourself whether your target audience can afford your service and whether they are willing to pay for it. Research competitor pricing to understand what the market already supports.

Your business idea should generate enough revenue to cover costs while leaving room for growth. A sustainable income model ensures your small business can survive and scale over time.

Identify Gaps in the Market

Many successful businesses grow by filling gaps others have ignored. Sometimes competitors lack personalization, good customer service, modern branding, or affordable pricing. If you can identify what’s missing, you can position your business as the smarter alternative.

The Winning Formula for a Profitable Small Business Idea

The strongest business ideas sit at the intersection of three powerful factors:

| Your Strengths | Market Demand | Profit Potential |

|---|---|---|

| Skills and experience you already have | People actively searching for or paying for the solution | Ability to generate sustainable income |

When these three align, your business idea becomes practical, scalable, and profitable.

Take your time with this step. Rushing into the wrong idea can cost you time and money. But choosing the right small business idea builds a strong foundation — and that foundation supports everything in your entrepreneurial journey.

2. Validate and Refine Your Idea

Before you invest your time, energy, and money into a small business idea, you need to validate it. Many aspiring entrepreneurs skip this step because they feel excited or confident — but that’s often where costly mistakes begin. Validating your business idea helps you reduce risk, avoid wasted investment, and move forward with clarity.

Step 1: Define and Understand Your Market

Start by clearly identifying your target audience. Who exactly will buy your product or service? Understand their age, income level, problems, buying behavior, and preferences. The more specific you are, the stronger your small business strategy becomes.

Next, study your competitors carefully. Look at what they offer, how they price their services, how they market themselves, and how customers respond to them. This helps you understand industry standards and spot opportunities for improvement.

Then, define your Unique Selling Proposition (USP). Ask yourself: Why should customers choose me instead of others? Your USP could be better quality, faster delivery, lower pricing, premium service, or a specialized niche focus.

Step 2: Test Before You Fully Launch

Before launching, test your idea on a small scale. This allows you to refine your offer based on real feedback rather than assumptions.

You can do simple market research like:

- Running social media polls to measure interest

- Analyzing competitor reviews to identify customer pain points

- Using keyword research tools to see if people are searching for your service

- Talking directly to potential customers and asking for honest feedback

These small validation steps give you powerful insights without major investment.

Why Business Idea Validation Matters

Validation builds confidence and reduces uncertainty. If people are already paying for similar products or services, that’s a strong signal that demand exists. Your goal is not to create demand from nothing — it’s to enter an existing market with a better, smarter offer.

When you validate and refine your business idea properly, you set yourself up for long-term success instead of avoidable failure.

3. Create a Simple Business Plan for Your Small Business

If you truly want to understand how to start a small business step by step, creating a clear and practical business plan is essential. You don’t need a complicated 50-page document. A simple, well-structured small business plan is enough to guide your decisions and keep you focused.

A business plan gives direction to your ideas. It turns a vision into a structured strategy and reduces the chances of costly mistakes. When you plan intentionally, you build your small business with purpose instead of guesswork.

Define the Problem Your Business Solves

Every profitable small business solves a specific problem. Before writing anything else in your business plan, clearly define what challenge your target audience faces and how your product or service provides a solution.

Ask yourself:

- What pain point does my customer have?

- Why does this problem matter to them?

- How is my solution different or better than competitors?

When your business idea is built around solving a real need, attracting customers becomes much easier.

4. Identify Your Target Market

Understanding your target market is a crucial part of creating a successful small business plan. Instead of targeting “everyone,” define a specific audience.

Describe your ideal customer in detail — their age, income level, location, lifestyle, and buying behavior. The clearer you are about who you serve, the easier it becomes to design effective marketing strategies and communicate your value.

A focused target market increases conversions and helps your small business grow faster.

5. Create a Strong Pricing Strategy

Your pricing strategy directly affects your profitability. When planning how to start a small business, you must decide how much to charge and why.

Research competitors in your industry and analyze their pricing structure. Then evaluate whether your target audience can afford your product or service and whether they are willing to pay for it. Your pricing should cover costs, generate profit, and remain competitive in the market.

A smart pricing strategy ensures your small business remains sustainable in the long term.

Develop a Practical Marketing Plan

No small business can succeed without marketing. Even the best products fail if customers don’t know they exist.

Your small business marketing plan should outline how you plan to attract customers. This may include building a professional website, investing in SEO, using social media marketing, running paid ads, or leveraging referrals and networking.

Consistency in marketing is more important than perfection. A clear plan helps you stay organized and focused on customer acquisition.

Estimate Startup Costs and Revenue Projections

Financial clarity is a critical part of any small business startup guide. Before launching, estimate your startup costs, including equipment, tools, inventory, software, and marketing expenses.

You should also project your expected monthly revenue and calculate how long it will take to reach your break-even point. Understanding these numbers helps you manage cash flow, avoid overspending, and make informed decisions.

6. Apply for Small Business Licenses and Permits

When learning how to start a small business legally, securing the proper licenses and permits is an essential step. The exact requirements depend on your industry, business structure, and location. Getting this right from the beginning protects your business from legal trouble and builds credibility.

Common Small Business Licenses and Permits

Depending on your type of business, you may need:

- General business license – Basic approval to operate in your city or state

- Professional license – Required for regulated professions (consultants, healthcare providers, etc.)

- Health permits – Necessary for food-related or health-based businesses

- Industry-specific permits – Special approvals based on your niche

Always verify requirements with your local authorities before launching.

Why Legal Compliance Matters

Skipping business licenses and permits can result in:

- Heavy fines

- Legal penalties

- Temporary suspension

- Permanent business shutdown

To successfully start a small business, ensure you meet all local legal requirements. Proper registration not only protects you but also builds trust with customers and partners.

7. Open a Business Bank Account

When learning how to start a small business properly, opening a separate business bank account is a crucial step. Many new entrepreneurs overlook this, but mixing personal and business finances can create serious accounting and tax problems later.

Keeping your finances separate ensures clarity, professionalism, and smoother financial management from day one.

Why You Need a Separate Business Account

Opening a dedicated small business bank account helps you:

- Track business income and expenses accurately

- Simplify tax filing and financial reporting

- Build business credit history

- Present a more professional image to clients

This separation makes bookkeeping easier and protects you during audits or legal reviews.

Documents Required to Open a Business Account

Most banks require the following to open a small business account:

- Business registration documents

- Valid identification proof

- Tax identification number

Although it may seem like a small administrative task, opening a business bank account early prevents financial confusion and supports long-term business growth.

8. Register Your Small Business for Taxes

If you’re serious about how to start a small business legally, registering your business for taxes is non-negotiable. Tax compliance is not something you can delay or ignore. The exact requirements depend on your country, business structure, and revenue model.

Before launching, check your local tax authority guidelines to ensure your small business is properly registered.

Common Tax Registrations for Small Businesses

Depending on your business activities, you may need to register for:

- Income tax – Applicable to business profits

- Sales tax or VAT – Required if you sell taxable goods or services

- Employer taxes – Necessary if you hire employees

Failing to register correctly can result in penalties, fines, or legal complications.

9. Build Your Team (If Needed)

When learning how to start a small business, remember that you don’t need a large team from day one. Many small businesses begin as solo ventures. However, as your workload increases and your customer base grows, building the right team becomes essential.

Scaling strategically helps you focus on growth instead of feeling overwhelmed.

When Should You Hire or Outsource?

If you constantly feel overloaded or unable to focus on high-priority tasks, it may be time to delegate. Depending on your needs, you can work with:

- Freelancers

- Contractors

- Virtual assistants

- Full-time employees

Start small and expand your team based on demand and budget.

Tasks You Can Outsource in a Small Business

Outsourcing allows you to maintain efficiency without hiring a full in-house team. Common areas small business owners delegate include:

- Marketing and social media management

- Website development and maintenance

- Accounting and bookkeeping

- Customer service support

Building the right team improves productivity, strengthens your operations, and allows you to concentrate on scaling your small business successfully.

10. Start Marketing and Making Money

Now comes the most exciting stage of starting a small business – launching and attracting your first customers. But here’s the reality: if people don’t know your business exists, you won’t generate revenue.

Marketing is not optional. It’s the engine that drives visibility, leads, and sales.

How to Get Customers for a Small Business

If you’re wondering how to get customers for a small business, focus on building a strong and consistent presence. Start with:

- Creating a professional website

- Optimizing your website for SEO to increase organic traffic

- Posting consistently on social media platforms

- Running targeted paid ads if your budget allows

- Networking within your industry

- Asking satisfied customers for referrals

The goal is to create multiple channels that bring potential customers to your business.

Focus on Consistency and Improvement

Success in small business marketing doesn’t happen overnight. Consistency matters more than perfection. Track your results, measure what’s working, and refine your strategy regularly.

When you continuously improve your marketing efforts, your small business gains visibility, builds trust, and increases revenue over time.

11. How Much Money Do You Need to Start a Small Business?

One of the most common questions when learning how to start a small business is about startup costs. The truth is, the amount of money you need depends largely on your industry and business model.

Service-based businesses often require minimal investment since they typically rely on skills, tools, and digital platforms. In contrast, product-based businesses usually involve higher upfront costs.

Costs for Product-Based Small Businesses

If you plan to sell physical products, your startup costs will usually be higher than service-based businesses. You’ll need to invest in inventory, purchase the necessary equipment or tools, arrange storage space, and set up packaging and shipping systems.

Understanding these expenses in advance helps you plan your budget properly, manage cash flow efficiently, and avoid unexpected financial pressure after launching your small business.

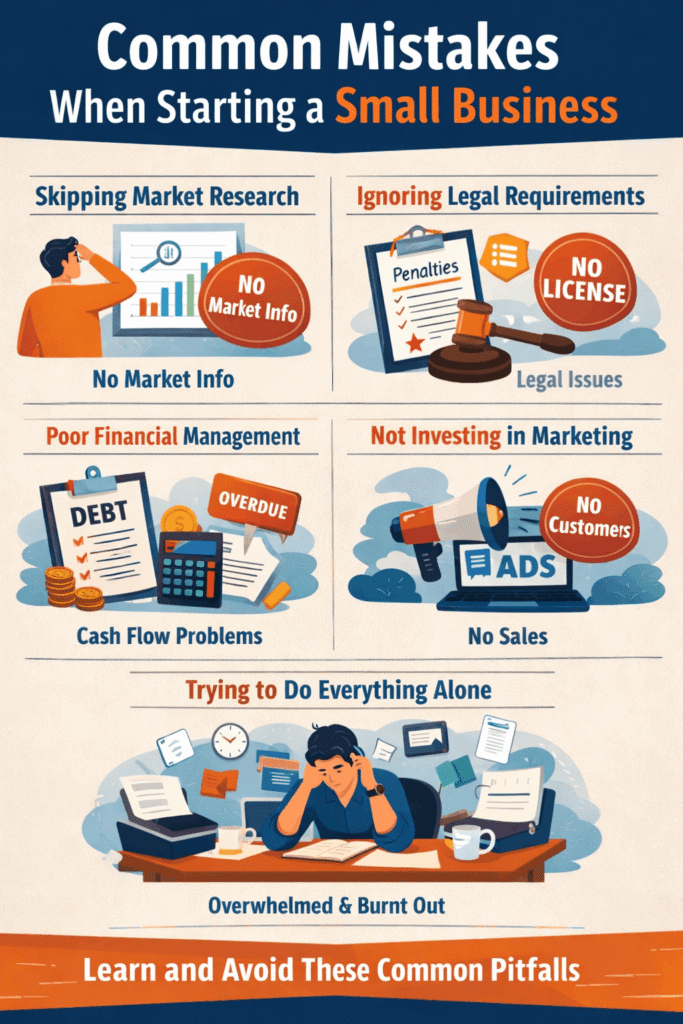

12. Common Mistakes When Starting a Small Business

When learning how to start a small business, understanding what not to do is just as important as knowing the right steps. Avoiding common mistakes can save you money, reduce stress, and increase your chances of long-term success.

Skipping Market Research

One major mistake is launching without proper market research. If you don’t understand your target audience, competition, and pricing expectations, your small business may struggle to attract customers. Research validates your idea and reduces risk.

Ignoring Legal Requirements

Failing to register your business, obtain licenses, or comply with tax regulations can lead to penalties or even business closure. Legal compliance is essential when starting a small business, and overlooking it can create serious complications.

Poor Financial Management

Many small businesses fail because of weak financial planning. Not tracking expenses, underestimating startup costs, or mismanaging cash flow can quickly lead to financial pressure. Proper budgeting and accounting systems are critical from day one.

Not Investing in Marketing

Even the best products won’t sell if people don’t know they exist. Avoid the mistake of neglecting marketing. Consistent promotion through SEO, social media, or paid advertising helps your small business gain visibility and customers.

Trying to Do Everything Alone

Handling every task by yourself may seem cost-effective at first, but it often leads to burnout. Delegating or outsourcing certain responsibilities allows you to focus on growth and strategic decisions.

Final Thoughts: You’re Closer Than You Think

Starting a small business can feel overwhelming at first. There’s paperwork, planning, decisions, and a lot of “What if this doesn’t work?” thoughts running through your mind.

That’s completely normal.

But here’s the thing – once you break it down into simple, manageable steps, it stops feeling scary and starts feeling possible. And now? You’re not guessing anymore.

You know everything about starting a business. The only real difference between people who want to start a business and people who actually build one? It’s your action.

You don’t need everything to be perfect. You don’t need to know every answer. You just need to start. Every successful entrepreneur you admire once had doubts. They once Googled the same questions. They once stood exactly where you are, at the beginning.

So maybe today isn’t just another day. Maybe today is the day you stop thinking about it… and take your first real step. Your future business is waiting.